You can efile marketable securities examples tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. Inventory costing methodshave to used once the unit cost of inventory is determined. These methods are used to bring a systematic approach in determining the cost of inventory.

- The return on most of these securities is low, because of the truth that marketable securities are highly liquid and are considered secure investments.

- In addition to giving a fair amount of overview on the above two, we have also discussed different models useful in taking decision on investments in marketable securities.

- Similarly, access to a range of exclusive software is an asset for an IT company.

- In other words, these assets have a useful life of over a year.

Mutual funds, commercial paper, treasury securities, and bank certificates of deposits. This quick ratio indicates that Cynthia can pay off all her current liabilities with quick assets and still can have some quick assets to go on. If the ratio is high, then the company may have excess liquid assets, which would allow it to easily manage its financial obligations and convert receivables into cash while still having excellent topline growth. The trade receivables in Nestle’s balance sheet for the year ended December 31, 2018 stood at Rs 1,245.90 million. Now, the company adopts a different approach to calculate accounts receivables.

Event Marketing Question Bank 2019 SYBMS

“Liquid” means the safety can easily be converted into cash on quick notice by the business that holds it. A marketable safety is a short-time period investment, that means the enterprise plans to hold it for lower than one yr. Current assetsis raw materials, finish products, and components, collectively known as inventory. But you need to think carefully about the consideration of this item in the list. In many industries, inventory is not as liquid as other resources because of the product getting manufactured.

If https://1investing.in/ flows that are receivable at different points in time have to be compared, the time value of money has to be taken into account. Mutual funds issue units of a scheme to investors to mobilise money and invest them on behalf of investors in securities. Exceptions can exist for short-term debt instruments such as Treasury-bills if they’re being used as collateral for an outstanding loan or line of credit. In other words, there can be no restrictions on converting any of the securities listed as cash and cash equivalents.

If it’s in this ideal situation, it signifies that your business is highly solvent in nature. The current resources must be at least equal to the current liabilities, if not greater. Consider looking for ways to generate more revenue in case the current resources exceed the value of current liabilities.

The ratio excludes inventory from the calculation, which is counterproductive for companies with high inventory. For example, supermarkets have high inventory which is easily valued at a marketable price. In such a situation, if the ratio only depends on cash or cash equivalent, results would lack accuracy. Even though both the current ratio and quick ratio measures the financial health of a company, there are certain differences between the two.

Companies that issue bonds also receive loans to meet their financial needs. Equity securities represent the ownership of shareholders of a company . They are realized in the form of equity capital shares, including both common stock and preferred stock.

Other Liquid Assets

Since the term represents a dollar value of all the resources that can easily yield cash in a short time frame. Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with a maturity date of three months or less. Marketable securities and money market holdings are considered cash equivalents because they are liquid and not subject to material fluctuations in value. Equity funds invest in a portfolio of equity shares and equity related instruments. The return and risk of the fund will be similar to investing in equity.

- Assets are valuable resources owned by a business, expected to create economic benefits for a business.

- Operation Freights When you invest in Bank deposits, you don’t have any pay any fund operation freights.

- Marketable equity securities embody investments in widespread and most popular inventory.

- Current assets cover accounts receivable, inventory, marketable securities, cash and cash equivalents, and prepaid expenses.

- This ratio includes such assets, which can be readily converted to cash.

In recent years, however, corporate bond issues have been of shorter maturities as inflation and economic uncertainties have caused investors to be less willing to commit their funds for longer periods of time. Many companies, which adopted the profit centre concepts, have made the finance department as one of the profit centres. It means the finance department has to add revenue to the firm. Top management wants financial department to show how they helped the company to improve the bottomline.

Long-term or fixed assets

It is one of the three core financial statements used for evaluating the performance of a business. The model basically optimise the flotation cost with the difference between interest outflow and interest income on marketable securities. This model helps the financial managers to decide on how much to be raised from the market given the requirement of funds and how much to be invested in marketable securities. On the other hand, the remaining four models guide the finance managers on how to switch funds from marketable securities to cash and vice versa. The net interest outflow in Option 2 is lower than the interest outflow of Option 1.

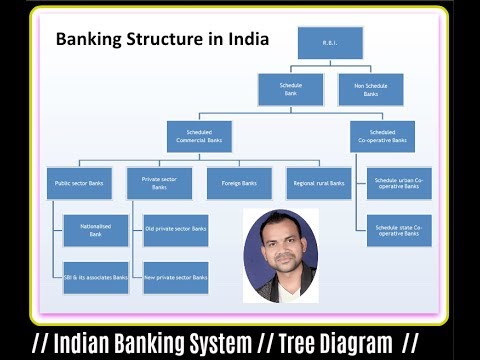

Common stockholders usually have voting rights that allow them to vote on the corporation’s board of directors. Since the board of directors hires the top management of the company, the stockholders indirectly determine the company’s management. From the definition it can be seen that “securities” can belong to both capital market and money market.

Assets may include investments, machinery, vehicles, inventory, patents, royalties, real estate, and more. Shri Ananta Barua, learned representative of the Respondent, reiterated the background of the case and facts as stated in paras 2 to 9 of the Respondents written reply to the appeal. Shri Barua stated that in terms of rule 4 of the 1993 Rules, every RTI is required to enter into a valid agreement with the issuer before taking up the assignment to act as RTI. Explain different types of securities available for investments. List out the different kinds of instruments in the money market. • Explain different types of securities available for investments.

Short-term investments, also known as marketable securities or short-term investments, are those which can simply be transformed to cash, sometimes inside 5 years. Many brief-term investments are sold or transformed to cash after a interval of solely three-12 months. Some widespread examples of brief term investments embrace CDs, cash market accounts, excessive-yield savings accounts, government bonds and Treasury bills. Usually, these investments are high-high quality and highly liquid assets or investment autos. A marketable security is a highly liquid monetary instrument, corresponding to publicly traded bonds or shares of inventory.

Marketable securities refers to property that can be offered inside a brief time frame, usually by way of a quoted public market. Marketable securities present investors with a liquidity corresponding to cash along with the ability to earn a return when the assets are not being used. A marketable safety is any equity or debt instrument that may be transformed into cash with ease.

Expert Assisted Services

Investors who are able to hold the scheme to maturity will be able to benefit from the returns of the FMP that are locked in when the portfolio is created. There is no risk of the value of the securities being lower at the time the fund matures since the instruments will also be redeemed at their face value on maturity. Stock brokers are registeredtrading membersof stock exchanges. They put through the buy and sell transactions of investors on stock exchanges. All secondary market transactions on stock exchanges have to be conducted through registered brokers.

Treasury notes have original fixed maturities of not less than one and not more than ten years from the date of issue. They are available in denominations as small as $ 1000, except that the T of less than four years are usually not issued for less than $ 5000. Treasury bonds are like notes in every respect in that their original maturities are from more than ten years to come as long as thirty years. Treasury Bills – This is a instrument issued by government of India for short term borrowings. Save taxes with ClearTax by investing in tax saving mutual funds online.