Content

Total revenue minus the money lost on returns, discounts, and allowances. This figure will appear in the direct cost portion of your income statement. The operating margin represents the proportion of revenue which remains after variable costs are subtracted. Sometimes referred to as return on sales, operating margin equals the operating income divided by net sales. First, gross profit margin does not take into account a company’s expenses, such as employee salaries, rent, and utilities.

If you know how much profit you want to make, you can set your prices accordingly using the margin vs. markup formulas. MarkupMargin15%13%20%16.7%25%20%30%23%33.3%25%40%28.6%43%30%50%33%75%42.9%100%50%So if you mark up products by 25%, you’re going to get a 20% margin (i.e., you keep 20% of your total revenue). First, find your gross profit by subtracting your COGS ($150) from your revenue ($200). Then, divide that total ($50) by your COGS ($150) to get 0.33. Then, divide that total ($50) by your revenue ($200) to get 0.25.

The Difference Between Operating Profits & the Bottom Line

One typical example of a variable cost is raw material required to produce an item, like the leather for a sneaker. One fixed cost would be the machinery used to produce that shoe, like a leather cutting device. Whether you build one or 100 widgets, the cost of the machine is the same. That means that the company can use 26.67% of each sale of a widget for other business purposes. The remaining 73.33% is used to pay for the cost of producing the widget.

- New businesses may have better percentages before needing to scale production and services.

- Net margin is $100k of net income divided by $700k of revenue, which equals 14.3%.

- Percent of gross margin is 100 times the price difference divided by the selling price.

- Customer research gives you a clear picture of the income and spending habits of your target consumer.

- Which financial metrics are most important will vary by company and industry.

When calculating your contribution margin, be careful to subtract only variable costs from your revenue or sales. These are items located below the line (i.e. below “gross profit”) on your company’s income statement. The expenses considered variable as opposed to fixed can be misleading. Both ratios are useful management tools, but reveal different information. Gross profit is your income or sales less cost of goods sold , which are all fixed costs .

Gross Margin: Definition, Example, Formula, and How to Calculate

It is important to specify which method is used when referring to a retailer’s profit as a percentage. Let’s consider an example and use the formulas displayed above. XYZ Company is in the online retail business and sells custom printed t-shirts. Calculate the gross and net profit margins for XYZ Company in 2018. In business accounting, standard margin and gross margin are two key indicators of a company’s economic health. Food trucks will generally carry similar food cost numbers as a brick-and-mortar restaurant, but they benefit from lower overhead costs including rent, insurance, staff and utilities.

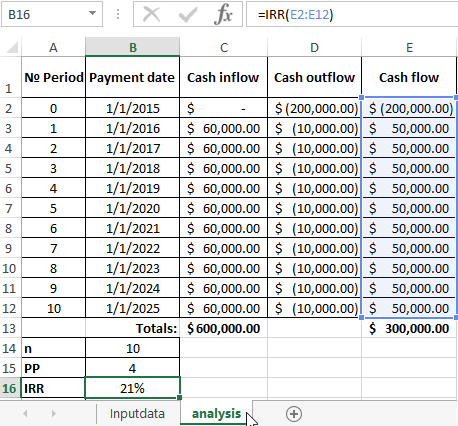

Which financial metrics are most important will vary by company and industry. For example, ROE may be a key metric in determining the performance of Company A, while the most helpful metric in analyzing Company B might be revenue growth rate. Below is a screenshot of CFI’s profit margin Excel calculator. As you can see from the image, the Excel file allows you to input various assumptions over a five year period.

What is a Profit Margin?

Basically, your margin is the difference between what you earned and how much you spent to earn it. Chat with one of our restaurant experts to see how software can help you streamline your operations and make informed decisions. Like we mentioned earlier, you can also substantially increase your sales per service. Equipped with that information, wait staff can approach a table when it’s marked as ready to pay, split the check however the guests want and accept payments right from their table.

- For example, ROE may be a key metric in determining the performance of Company A, while the most helpful metric in analyzing Company B might be revenue growth rate.

- If you worry that increasing prices will scare customers away, you can alternatively increase profit margins by decreasing food costs.

- Retailers and wholesalers or distributors purchase items for inventory.

- You spend the other 75% of your revenue on producing the bicycle.

Upon dividing the $7 million in gross profit by the $10 million in revenue and then multiplying by 100, we arrive at 70% as our GM %. Based on the 70% GM, we can gather that the company standard margin formula has earned $0.70 in gross profit for each $1.00 of revenue. For example, if a company has generated $10 million in revenue with $3 million in COGS, the gross profit is $7 million.

By the same token, standard margins can be reduced by cutting expenses such as employee salaries. To calculate profit margin, start with your gross profit, which is the difference between revenue and COGS. Then, find the percentage of the revenue that is the gross profit.

- 30% of their monthly revenue on labor , optimizing your employee scheduling is an excellent and easily-accessible way to increase revenues and decrease ongoing expenses.

- Do this by finding cheaper vendors for ingredients (but don’t sacrifice quality!) or serving smaller portion sizes.

- Revenue.” Revenue is all of the money that a company generates.

- There is no hard and fast rule for what constitutes a good gross margin, but it must be at least enough to cover expenses.

Like gross margin, business results will improve and your firm will grow in value. Once you’ve found the average gross margin in your field, you should attempt to meet or exceed the average. Like when you buy a new piece of software, you may incur costs to train your staff. A business consumes direct materials to manufacture a product or provide a service. A product’s bill of materials lists the quantity and cost needed to make a product. Contribution margins represent the revenue that contributes to your profits after your company reaches its break-even point .

But it does not account for important financial considerations like administration and personnel costs, which are included in the operating margin calculation. Calculate the gross margin percentage, mark up percentage and gross profit of a sale from the cost and revenue, or selling price, of an item. For net profit, net profit margin and profit percentage, see the Profit Margin Calculator. If income statements are available on a monthly or quarterly basis, compare the gross margin figures. If margins are rising, that may be an indicator of improved efficiencies. It can also indicate that lowering prices to increase sales is having a negative impact on financial stability.

When done right, creating your own hashtag and promoting it is a great way to increase awareness and gain positive exposure for your restaurant business. Rewarding regular guests is a great way to build your loyal customer base and increase positive word of mouth. But in order to do this, you’ll need to get new customers in the door first—and turn them into fans.